Understanding the difference between Social Security and Medicare is essential for anyone planning retirement or approaching age 65 in the United States. Although these two federal programs are often mentioned together and are closely connected, they serve very different purposes within the U.S. social safety net.

Confusing Social Security with Medicare can lead to poor financial or healthcare decisions later in life. Knowing how each program works, how they interact, and when to enroll can make a significant difference in both retirement income and medical costs.

This guide explains what Social Security and Medicare are, how they differ, and how they work together so you can make informed and strategic decisions.

Overview of Social Security and Medicare

Social Security and Medicare are federal programs designed to provide long-term security for American citizens. While they are frequently discussed as a pair, their roles are clearly distinct.

Social Security provides financial income in the form of monthly payments to retirees, people with disabilities, and surviving family members of deceased workers. Medicare, by contrast, is a health insurance program that helps cover medical costs, primarily for people aged 65 and older and certain younger individuals with disabilities.

In practice, the connection between these two programs is significant. Enrollment in Medicare is often automatic for individuals already receiving Social Security benefits, and Medicare premiums are commonly deducted directly from Social Security payments.

Because of this interaction, decisions related to one program often affect the other, especially when it comes to budgeting, healthcare planning, and retirement timing.

What Is Social Security?

Established in 1935, Social Security is a federal program created to provide economic security to American workers and their families. It pays benefits to retired workers, individuals with qualifying disabilities, and surviving spouses and children of deceased workers.

Social Security benefits are calculated based on an individual’s earnings history and the age at which benefits are claimed. Generally, people who earned more over their working years and paid more into the system receive higher monthly payments.

For many Americans, Social Security represents the foundation of retirement income. While it was never intended to replace all employment income, it provides a predictable and reliable monthly payment that helps cover essential living expenses.

This consistency makes Social Security a critical element of long-term financial planning, particularly for individuals who may have limited savings or pensions.

What Is Medicare?

Medicare is a national health insurance program created in 1965 to ensure access to healthcare for older Americans and certain disabled individuals. It helps reduce the financial burden of medical expenses during retirement.

Medicare is divided into several parts. Part A covers hospital care, Part B covers medical and outpatient services, Part D provides prescription drug coverage, and Part C, also known as Medicare Advantage, allows beneficiaries to receive coverage through private insurance plans that combine multiple services.

Medicare plays a vital role in maintaining health and financial stability in later life. While it does not cover every medical expense, it significantly lowers out-of-pocket costs for doctor visits, hospital stays, preventive services, and medications.

Without Medicare, healthcare costs in retirement could quickly become overwhelming for many individuals.

Key Differences Between Social Security and Medicare

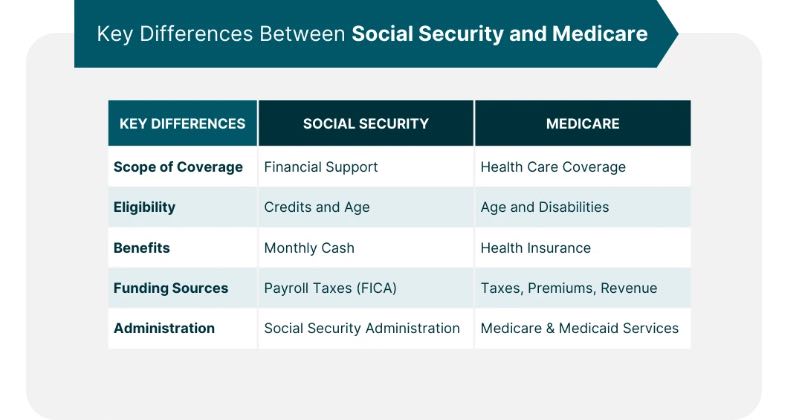

Scope of Coverage

The most fundamental difference between Social Security and Medicare lies in what they provide. Social Security offers income replacement, helping individuals pay for everyday expenses such as housing, food, and utilities.

Medicare, on the other hand, focuses exclusively on healthcare coverage. It helps pay for medical services, treatments, hospital care, and prescription drugs but does not provide cash payments for personal expenses.

Eligibility Requirements

Eligibility rules for the two programs are different. Social Security eligibility depends on earning enough work credits and meeting age or disability requirements.

Medicare eligibility is primarily based on age, with most people qualifying at 65. However, individuals with certain disabilities or medical conditions may qualify earlier, even if they are not yet receiving Social Security retirement benefits.

Benefits Provided

Social Security provides a monthly cash benefit paid directly to the recipient. The amount depends on lifetime earnings and the age at which benefits are claimed.

Medicare does not pay cash to beneficiaries. Instead, it provides insurance coverage, paying healthcare providers directly for covered services.

Funding Sources

Social Security is funded mainly through payroll taxes collected under the Federal Insurance Contributions Act (FICA).

Medicare is also partially funded through payroll taxes, but it relies heavily on beneficiary premiums and general federal revenue, particularly for Parts B and D.

Administration and Management

Social Security is administered by the Social Security Administration (SSA), while Medicare is managed by the Centers for Medicare & Medicaid Services (CMS). Although both are federal agencies, they operate independently with different administrative structures.

Interactions Between Social Security and Medicare

Coordination of Benefits

For individuals eligible for both programs, Social Security and Medicare are closely coordinated. In many cases, people who are already receiving Social Security benefits are automatically enrolled in Medicare Part A when they become eligible.

This coordination helps ensure continuous healthcare coverage while allowing Social Security income to help offset medical costs. Understanding how this process works can prevent coverage gaps and unnecessary penalties.

Impact of Social Security on Medicare Premiums

One of the most important interactions involves Medicare premiums. Most beneficiaries have their Medicare Part B premiums automatically deducted from their Social Security payments.

Higher-income individuals may also be subject to the Income-Related Monthly Adjustment Amount (IRMAA), which increases monthly Medicare premiums. Additionally, cost-of-living adjustments (COLA) to Social Security benefits can influence how much income remains after Medicare deductions.

Being aware of these factors is essential for accurate budgeting and long-term financial planning.

Which One Is Right for You?

Social Security and Medicare are not alternatives to each other. Instead, they serve complementary roles in retirement planning.

Social Security provides financial stability through consistent income, while Medicare ensures access to healthcare. Most people will rely on both programs simultaneously during retirement.

The key decisions involve timing. When you claim Social Security and when you enroll in Medicare can affect benefit amounts, premiums, and potential penalties. Evaluating your health, employment status, and financial situation helps determine the most effective strategy.

What Is the Difference Between Social Security and Medicare? FAQs

Can I receive Social Security and Medicare at the same time?

Yes. Many individuals receive Social Security benefits while being enrolled in Medicare, and automatic enrollment often occurs at age 65 if Social Security benefits have already begun.

Does Medicare coverage affect my Social Security benefits?

Medicare enrollment does not reduce Social Security benefits, although Medicare Part B and Part D premiums may be deducted from monthly payments.

If I delay my Social Security benefits, will this affect my Medicare coverage?

Delaying Social Security does not affect Medicare eligibility. However, enrolling in Medicare on time is important to avoid late enrollment penalties.

Are Social Security benefits used to pay for Medicare?

Social Security benefits are not directly used to fund Medicare, but they are commonly used to pay Medicare premiums through automatic deductions.

What happens if I am still working at age 65?

If you are still employed and have employer-sponsored health insurance, you may be able to delay Medicare enrollment without penalties. It is important to confirm coverage rules with your employer and Medicare before making a decision.